IgnitionCasino ReviewAnalytics & Statistics

Ignition Overview

Established

2016Company

Lynton Limited

Our team, headed by Oliver Miller, finalized the statistics by January 10th. Although the data reflects the situation as of March 1st, we invest substantial time and effort in analysis. Lily Adams is responsible for publishing the refined data, ensuring it's both accurate and insightful for our audience.

Restricted Countries

India, Indonesia, Thailand, United Kingdom, Vietnam

Languages

English

Software Provider

Real Time Gaming, BGaming, Lightning Box, Spinomenal, Genesis Gaming, Spadegaming, Revolver Gaming

Casino Games

Payment Methods

License

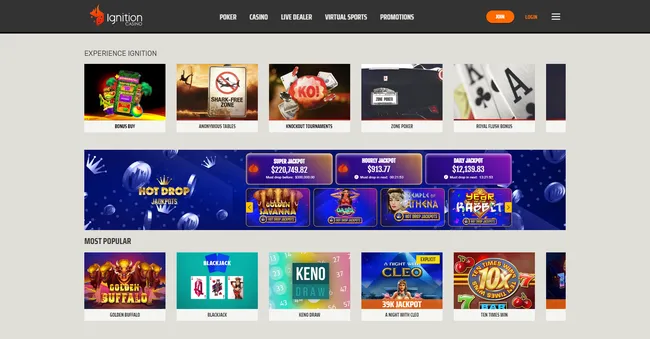

Ignition Casino Overview

Ignition Casino is licensed and regulated out of Curacao. When you compare this with some of its competitors like Slots.lv, which has its unique features, or Bovada, known for its player base, Ignition Casino holds its ground with distinguishing characteristics.

Diving into its numbers tells a compelling story. With over 345,000 visitors per month, averaging 832 minutes per session, there's a clear indication of its popularity. Moreover, the average bet size stands at a modest $3.56 suggesting that most players approach their gaming sessions with caution and prudence.

While Vave may have similar statistics, it's the unique offerings and player experiences that set each casino apart.

While every casino, including Ignition and its rivals like LTC Casino and Fairspin, has areas to refine, Ignition makes a concerted effort to stand with its community by offering a transparent, player-friendly platform.

Analytics & Statistics

Bonuses

Website Traffic

Total Users

> 345,000

Session Duration

13 min 52 sec

Total Spins

> 50 Million

Return to Player %

90.07 %

Player satisfaction rate

22.83 %

Average bet size per user

3.56 $

Average time between withdrawals

16 days

New user registrations

20.19 %

Active users

27.4 %

Users who play with maximum bets

> 4.61 %

Players using bonuses

44.98 %

Users complete wagering requirements

33.11 %

Average deposit frequency per user

5.57

Average time between deposits

22 days

Average withdrawal amount per user

$ 4.97

Most popular time for playing

8:00-10:00

Deposit Multiplier Chart

Discover the power of data visualization to enhance your online casino experience with our innovative deposit multiplier chart. This cutting-edge graph showcases the percentage of players who have successfully multiplied their deposits by 2x, 5x, 10x, and even 100x at various online casinos. By analyzing this insightful chart, you can gain a deeper understanding of your winning odds and make more informed decisions when selecting the perfect casino to suit your preferences.

Volatility Chart

26.07% prefer high volatility games

46.06% prefer low volatility games

27.87% prefer medium volatility games

Users who play with maximum bets

> 4.61 %

Average deposit frequency per user

5.57

Ignition - Payment Methods

Regular Payment Methods

Best Online Slots in Ignition Casino

Browse the full slot library. 7 providers with up to 96.7% RTP and 0x max win.

96.7%

Top RTP

0x

Max Win

95.8%

Avg RTP

50

Showing

96.7%

Best RTP

0x

Max Win

7

Providers

Yggdrasil Gaming

Starfire Fortunes TopHit

Relax Gaming

Cosmic Rush Dream Drop

Blue Guru Games

Aussies vs Emus

iSoftBet

Merlin's Magic Mirror Megaways

Blueprint Gaming

Bounty Hunter Unchained

Red Tiger

Astros

Blueprint Gaming

Rise of Atlantis 2

Blueprint Gaming

5 Pots o' Riches

Blueprint Gaming

The Goonies Return

NetEnt

Pirates Party

Relax Gaming

Swag Bag Bonanza

Is Ignition Legit & Safe?

Year Established

2016Company

Lynton Limited

Reputation Ratings

Trustpilot Rating

0.75out of 5

AskGamblers Rating

6.74out of 10

CasinoGuru Rating

5.7out of 10

License Details

License Status

Licensing Authorities

Curaçao Gambling License

Curaçao is one of the earliest jurisdictions to regulate online gambling. Its licensing process is known for its affordability and efficiency.

Key Features

- Single License System: Curaçao offers a single license that covers all types of gambling.

- Cost-Effective: Compared to other jurisdictions, Curaçao's licensing fees are relatively low.

- Quick Processing: The application process is usually swift, often completed within a few weeks.

Challenges and Considerations

- Reputation: While accessible, Curaçao's license is sometimes viewed as less prestigious.

- Regulatory Compliance: Operators must adhere to local laws and international regulations.